![]() photo credit: geoftheref

photo credit: geoftheref

Studying abroad continues to be one of the top five interests of college bound students according to Brooke Roberts, an expert in international education and founder of http://insidestudyabroad.com. According to the Open Doors 2010 Report on International Education Exchange, an annual report published by the Institute of International Education with funding from the U.S. Department of State’s Bureau of Educational and Cultural Affairs, 260,327 students studied abroad for credit during the academic year 2008/2009.

“Studying abroad is right for just about any student barring any health or physical restrictions. The real question is what program is right for you,” said Roberts. “Students need to think about the why, what, where and how of study abroad.”

In order to help students prepare for a successful study abroad experience, Roberts recommended the following tips for students during #CollegeChat.

1. Contact your university’s study abroad office. According to Roberts, a student’s study abroad office should be their primary source for study abroad information. After you research opportunities with your school’s study abroad office you should also research programs through online directories like GoAbroad.com.

2. Make sure to investigate the full range of study abroad programs. College students have a multitude of study abroad programs available to choose from ranging from two weeks to a full calendar year. According to the Open Doors 2010 Report, 55 percent of U.S. students choose short term programs, 41 percent choose mid length programs while a little more than 4 percent choose a full academic or calendar year program. Short term programs are the most popular, according to the report, because they offer the greatest financial and academic flexibility.

3. Select a study abroad program that is on your university’s approved list. Most universities’ study abroad offices maintain a list of university approved programs that guarantee students academic credit if attended and requirements met. “Don’t get stuck paying for a program that your university won’t recognize for credit. It’s a huge headache,” reports Roberts.

Also make sure that the program you are interested in has also been approved by your school for financial aid. “Universities typically limit the number of study abroad programs to which students can apply federal and institutional aid. By selecting a program that is approved for credit and financial aid students can save buckets of money,” said Roberts.

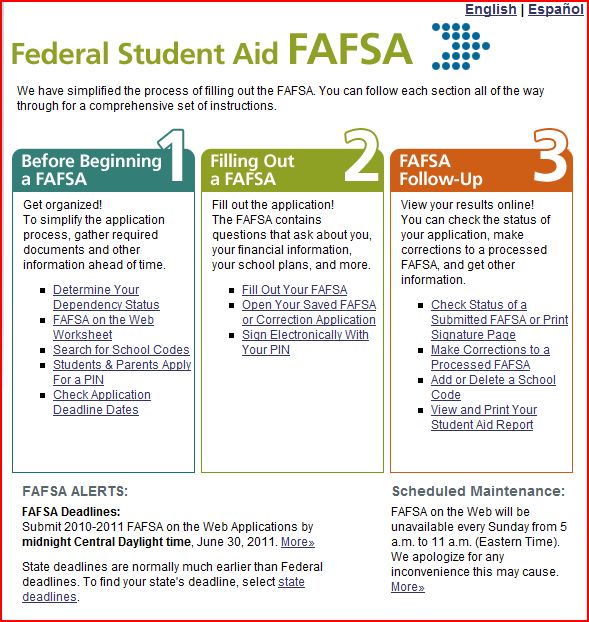

4. Check in with your financial aid office. Once you have narrowed down your choices make sure to review them with your financial aid office. Make sure you understand how your financial aid award will apply to the program. In addition, check that your financial aid award factors in any other expenses you may have while studying abroad. “Students should also make sure to complete the FAFSA before studying abroad –even if they don’t think they will qualify. Since studying abroad is often more expensive than staying on campus, students will often qualify for more aid,” explained Roberts.

5. Consider exchange programs especially if finances are a concern. Exchange programs can often be the best financial deal for students according to Robert. Exchange programs are agreements between a American university and a university abroad. The agreement calls for students to swap places but continue to pay their home school costs. Exchange programs are best for independent, driven students since there is less support available to them.

6. Talk with students who have participated in study abroad program you are interested in. A fellow student that has already been on the program you are interested in is generally a good place for advice. Make sure to find out about their experience and whether they would recommend the program.

7. Search for scholarships. Study abroad scholarships are typically for students going to non- traditional locations such as South America, Africa, the Middle East, Russia and Asia. According to Roberts, it is more difficult to find scholarships for Europe since it’s the most popular destination. Robert recommends students check out GoAbroad.com for scholarships at http://scholarships.goabroad.com/index.cfm. Students need to begin looking for scholarships at least nine months before they plan to go abroad. Most scholarships have a deadline to apply a semester before the student plans to study abroad.

8. Consider adding an internship to your study abroad program. Many study abroad programs that last at least a semester include an internship. “Interning abroad can be the one two punch that helps land a student a job after graduation,” said Roberts.