International Education Expert to Discuss What College Students Need to Know about Studying Abroad on #CollegeChat

Brooke Roberts, an expert in international education and founder of http://insidestudyabroad.com , will discuss what college students need to know about studying abroad on #CollegeChat on Twitter on November 16, 2010 at 6 p.m. Pacific/ 9 p.m. Eastern.

During #CollegeChat, Roberts (http://twitter.com/instudyabroad), will address a number of issues to consider about studying abroad including:

- How to determine if studying abroad is right for you

- How do you begin the research for a study abroad program

- How to make sure the program is safe, reputable and your college will accept the credits

- How to pay for study abroad

- Will study abroad be viewed as meaningful to future employers or graduate school

- Should you include an internship in your study abroad program

Brooke Roberts is an expert on international education having studied abroad three times during college, worked in two university study abroad offices, consulted on international education, and worked for three study abroad companies. Brooke earned a BA in International Affairs & Political Science from Northeastern University and a MA in Higher Education & Student Affairs from Bowling Green State University. Since then she has taught English in China, helped students intern abroad with EUSA Academic Internships, worked on the Semester At Sea Fall ’08 voyage, developed the study abroad office at the University of South Dakota, and is now Marketing Manager with CIS Abroad. Brooke writes about international education at www.InsideStudyAbroad.com, and you can follow her on Twitter at http://Twitter.com/thenewdorothy and http://Twitter.com/instudyabroad .

About #CollegeChat

#CollegeChat is a live bi-monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. #CollegeChat takes place on the first and third Tuesday of the month at 6 p.m. Pacific/ 9 p.m. Eastern. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. More detailed information about signing up for Twitter and participating in #Collegechat can be found at http://pathwaypr.com/how-to-participate-in-a-twitter-chat .CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .

Financial Aid Myths and Facts for College Bound High School Students and Parents on Next #CollegeChat

Sharon McLaughlin, a college planning consultant and financial aid expert and founder of McLaughlin Education Consulting (http://www.headforcollege.com) , will discuss with college bound teens, college students and parents why it is important to know the facts about financial aid and not the myths during the next #CollegeChat on Twitter on November 2, 2010 at 6 pm Pacific/ 9 pm Eastern.

Sharon McLaughlin, a college planning consultant and financial aid expert and founder of McLaughlin Education Consulting (http://www.headforcollege.com) , will discuss with college bound teens, college students and parents why it is important to know the facts about financial aid and not the myths during the next #CollegeChat on Twitter on November 2, 2010 at 6 pm Pacific/ 9 pm Eastern.

During #CollegeChat, McLaughlin ( http://twitter.com/shashmc) , will dispel the most common financial aid myths including:

- My parents make too much money to qualify for financial aid

- Applying for financial aid will hurt my child’s chance to get into a highly selective college

- Financial Aid is not available for families making over $160,000 a year

In addition, McLaughlin will also address:

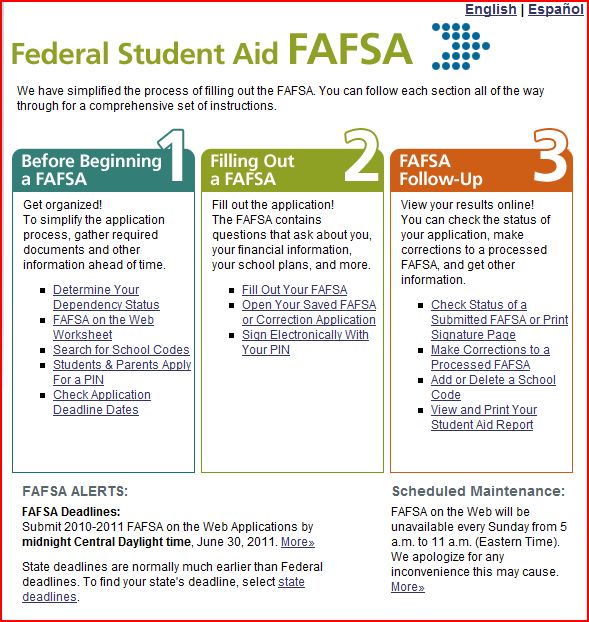

- How to apply for financial aid

- What financial aid consists of

- Why it is important to file for financial aid as soon as possible

- What to do if your parents refuse to fill out the FAFSA

- How do you consolidate student loans and why is this important

- What do you do if you can’t make your student loan payment due to a financial crisis

Sharon McLaughlin is a former college administrator with more than twenty years of experience in student enrollment services. Sharon draws her expertise from her work at private and public colleges in New England, both as a college admissions and financial aid administrator. Sharon holds a MEd in Adult Education and was the first professional college planning consultant in Central Massachusetts to receive the designation of Certified College Planning Specialist (CPPS) from the National Institute of Certified College Planers (NICCP). In 2008, Sharon was honored as a “Woman of Achievement” by the Center for Women & Enterprise in Worcester, Massachusetts.

About #CollegeChat

#CollegeChat is a live bi-monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. #CollegeChat takes place on the first and third Tuesday of the month at 6 pm Pacific/ 9 pm Eastern. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. More detailed information about signing up for Twitter and participating in #Collegechat can be found at http://pathwaypr.com/how-to-participate-in-a-twitter-chat . CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .

7 Practical Tips on How College Students Can Save Thousands on College

As college students head back to college, many families are struggling with how they are going to meet their college education costs. During a recent session on #CollegeChat on Twitter, Kathy Kristof, (http://twitter.com/kathykristof ) a nationally syndicated personal financial columnist and author of “Investing 101”, shared a number of tips that can help college students shave thousands of dollars off their education expenses.

Check the graduation rate. Before you sign on the dotted line, make sure you know what the school’s graduation rate is recommends Kristoff. “Tuition money is wasted if you don’t graduate and some schools graduate only a few of those who start,” said Kristof. “Private trade schools are notorious for this and they charge as much as prestigious private schools.”

Go to College Navigator, a site operated by the Department of Education, at http://nces.ed.gov/collegenavigator/ and look up graduation rates by school.

Make sure to claim your AP credits. Many students neglect to check to see if their Advanced Placement (AP) classes will transfer. Some colleges set deadlines on how long students have to claim these credits. Remember, the $86 students paid to take an AP test can save you thousands in college tuition. As Sharon McLaughlin (http://twitter.com/shashmc) , founder of McLaughlin Education Consulting, pointed out, “Any course you can be exempt from via AP credit or CLEP will save you the tuition for the course.”

In addition, students who received scores of 3 or higher on at least three AP exams should check with their college to see if they have sophomore standing. If you have sophomore standing and attend a public university you may have saved yourself at least $6,585, the average tuition and fees at a four year public university according to 2008 Trends in College Pricing from the College Board. Students can check out www.collegeboard.com/ap/creditpolicy to see if your AP score may have earned you college credit.

Consider attending Junior College—even for just summer school. “Junior colleges are the best bargain in education,” Kristof explained. “One year at Pasadena City College costs $600 versus $30,000 at a private four year college. In addition, a kid who can’t get into the school he wants straight out of high school can go to a junior college, get a B average and go almost anywhere in two years.”

Grayson Page ( http://twitter.com/g_page ) recommends that students “look at transfer agreements outlined by four year colleges, check the amount charge per credit hour, check College Navigator for completion rates, and register early.”

If enrolled at a four year college, students should consider attending a junior college for summer school. By attending summer school, students can potentially save hundreds if not thousands off their college expenses. Just make sure to take the description of the course(s) you are considering to your college advisor to make sure they will accept the credits.

Look for textbooks online. By buying books online, students can potentially save up to 75% of the list price of new textbook, and with textbooks on average approaching $1000 per year for students that can be quite a savings. The best deals are on used textbooks. Comparison shopping sites like http://bigwords.com/ and http://BestBookBuys.com can compare prices at multiple online stores instantly including on the cost of renting textbooks. Kristof also recommends that students look into borrowing their textbooks at the college library or even the local public library as well as swapping books with friends.

Sign up for Skype. By having Skype, students can have an online video chat for free, even internationally, if both people on the “call” are online. Most dorms do not have land lines anymore. If Skype isn’t for you, there are a number of other video chat options. Akil Bello, (http://twitter.com/akilbello) the vice president of Educational Development for Bell Curves, commented that all the “IM programs now have some form of video chat.”

Tauhid Chappell (http://twitter.com/TauhidChappell), a junior at Virginia Tech, also recommends that students get an unlimited text plan for their cell phone service.

Limit Meal Plans. Meal plans can be very expensive and many students won’t use a full meal plan. Suzanne Shaffer (http://twitter.com/SuzanneShaffer) founder of Parents Countdown to College, advised that families “never buy the full meal plan. They won’t use it.”

Kristof recommends that students invest in a fridge for their rooms and stock it with healthy foods. With a fridge, students can forego trips to the cafeteria for some of their meals and get by on a less expensive meal plan. Students may also be able to “work for food” either in the cafeteria or possibly as “hashers” for sororities. Kristof also mentioned that students check out http://groupon.com/ for the best dining deals.

Chandra Robrock ( http://twitter.com/FSUfashiongirl) , a full time college student and part time fashion blogger, suggested that college students sign up for Twitter and look for deals from their favorite eateries. She also recommended that students know what restaurants offer discounts or specials to college students. “The best way to find out about deals is to check their website directly and sometimes there is a coupon you can print out,” said Robrock.

Be careful with borrowing. If you need to take out a loan to pay for college, Kristof recommends that students take out federal loans and only up to the point where the federal loans max out. According to Kristof, “Private loans should be used sparingly if at all. To check them out go to http://www.finaid.org/. Borrowing—particularly private borrowing—should be a last resort.”

However, if you have run out of options and still need to consider a private loan, McLaughlin recommends that undergraduates check with http://www.studentchoice.org/ , a provider of private student lending services to credit unions.

Kathy Kristof is an award winning syndicated financial columnist and author of three books “Investing 101”, “Taming the Tuition Tiger: Getting the Money to Graduate”, and “Kathy Kristof’s Complete Book of Dollar and Sense”. She writes about an array of financial issues, ranging from the impact of legislation to taxes to credit card and financial planning. Nearly 40 million people in more than 50 major newspapers nationwide read her columns, including the Los Angeles Times and the Chicago Tribune. Kristof also writes the “Devil in the Details” column for CBS MoneyWatch. In addition to writing, Kristof is a frequent lecturer at investment conferences and has also appeared on a variety of radio and television news broadcasts.

About #CollegeChat

#CollegeChat is a live bi- monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .

Last Minute Tips for College Students to Save Hundreds on Textbooks

Disclaimer: Best Book Buys is a client.

![]() photo credit: brainchildvn

photo credit: brainchildvn

LA CANADA, CA, August 10, 2009 –Over the next month more than 19 million college students will head back to college during the deepest recession of their families’ lifetimes. But, according to Steve Loyola, president and founder of Best Book Buys (http://www.bestbookbuys.com/), a leading online comparison shopping service for books and a service of Best Web Buys, students can save hundreds of dollars on their textbooks.

“Although times are certainly tough, today’s college students have so many choices for acquiring their college textbooks,” said Loyola. “By venturing outside their college bookstore, and going online, students can save hundreds of dollars on their textbooks.”

Loyola offers the following tips to save money on textbooks:

- Start now and order early. If you have your fall schedule and are away from campus, you can check to see if your professor has a syllabus online or can simply email your professors requesting the book lists. The lowest priced and highest quality used textbooks are most often found when supplies are at their highest.

- See if your school has a book swapping site. Just google the name of your school and book swap (e.g., “UCLA book swap”). Also, use Facebook to see if any of your friends have the book you need.

- Check to see if the college library has your textbook available. If so, you might be able to read it at the library instead of purchasing it.

- Use comparison shopping sites like BestBookBuys.com which search the Internet for your textbooks across thousands of sellers. BestBookBuys compares the cost of more than 6 million book titles and also enables consumers to compare the costs of books via their cell phones at http://m.bestbookbuys.com/ .

- Compare the costs of buying used, new and international textbooks against the price of renting textbooks or electronic textbooks. When you compare costs, also factor in the amount of money you might get to sell your textbook at the end of the semester. If you rent, you will not recoup any of your purchase. In addition, renting a book requires returning the book in good condition or you will be required to purchase it at the end of your rental term. Also realize that semester, quarter, and summer rental periods usually refer to a certain number of days (e.g., 125, 85, 60). Even if you are on a semester schedule, if you only need a book for part of the semester, save money by choosing the quarter or summer rental if that’s long enough for your needs.

- Consider buying an international edition. An international edition may have a paperback cover instead of a hardcover and may have different text or graphics than the U.S. version. Before purchasing any alternate edition, check the seller’s website to confirm that the book has the same content as the U.S. edition.

- Check availability and shipping time before ordering. Buying from the least expensive seller is probably not a good deal if the book isn’t immediately available.

- Check for store coupons and free shipping offers. Google the store name and coupon (e.g., “Amazon coupon”).

- Before ordering, check out the store’s reputation and return policy. You want to make sure the store will accept returns and that the store provides ample time to return your books in the event you change classes.

- Don’t forget to sell books back when the semester is over. Best Book Buys has links to participating online bookstores that buy textbooks at http://www.bestwebbuys.com/books/buyback.html

Eight Tips for College Students to Save Thousands of Dollars on College Costs

Disclaimer-Client news release

LA CANADA, CA, July 27, 2009— Over the next month nearly 19 million students are set to return to college campuses across the country during the worst economic crisis in more than 70 years. Making matters worse, over the last 25 years, tuition and fees have risen four times faster than the rate of inflation. But according to Steve Loyola, president and founder of Best Book Buys (http://www.bestbookbuys.com), a leading online comparison shopping service for textbooks and books, students can save thousands of dollars off their 2009/2010 college costs

“These are very challenging times for students and their families,” said Loyola. “But, with a little planning, research and good bookkeeping, students and their families can save thousands of dollars off expenses including textbooks, room and board, taxes, car expenses, health insurance and cashing in on AP credits. You just need to get started now and not delay.”

Loyola recommends the following tips:

- Buy textbooks online. According to the College Board’s Annual Survey of Colleges, students spend more than $1000 per year on books and supplies. By comparing the cost of buying textbooks at an online comparison shopping site like BestBookBuys.com, students can save up to 76 percent off the list price of their textbooks. BestBookBuys.com compares the cost of renting or buying used, new, and international textbooks across thousands of online sellers and online stores including eBay, Amazon, Barnes & Noble, Abebooks, Powells, Textbooks.com, Chegg, half, Overstock and many others. BestBookBuys compares the cost of more than 6 million book titles and also enables consumers to compare the costs of books via their cell phones at http://m.bestbookbuys.com

- Compare the cost of meal plans. Meal plans vary widely in price and the number of meals allowed. For example, at Occidental College meal plans range from $1,790 to $2,615 per semester and at Vassar College meal plans range from $2,140-2,742.50 per semester. By selecting a mid range plan, students can save hundreds of dollars annually.

- Consider making a financial aid appeal. If your family’s finances have taken a detour in 2009 compared with 2008, do consider filing an appeal with your financial aid office. Check your college’s website for instructions. If you can’t find instructions, call your college’s financial aid office. If one of your parents lost their job or the family income was reduced, explain in detail. If you haven’t applied for financial aid, do so by filling out the Free Application for Federal Student Aid (FAFSA).

- Don’t forget to claim the new higher education tax credits made available by the stimulus plan signed in February. Under the credit, taxpayers can get a reduction in their 2009 tax bill of up to $2500 per student provided the tax filers have an adjusted gross incomes of less than $80,000 a year (if single) or $160,000 (if they file jointly). An eligible family with two kids in college could get a tax credit of $5,000. In order to get the credit, you will need to fill out IRS form 8863.

- Check your health insurance. Many colleges charge a built-in fee for health insurance through the college. If you are already insured on your parent’s policy, appeal this amount. At the University of California Irvine, for example, you could save $671 per year if covered under a separate health insurance policy.

- Leave your car at home. By leaving your car at home you will not only save on the amount you pay in car insurance but also on parking permits ($711 annually at UCLA and $568 annually at the University of Arizona), gas, oil and other upkeep. Check out instead if your college town offers free public transportation to students, many do.

- Make sure to claim your Advanced Placement (AP) credits. By now, incoming freshmen have received their AP scores. Check out www.collegeboard.com/ap/creditpolicy to see if your score may have earned you college credit. In addition, if students received scores of 3 or higher on at least three or more AP Exams, they should check with their college to see if they have sophomore standing. If you have sophomore standing and attend a public university you may have saved yourself at least $6,585, the average tuition and fees at a four year public university according to 2008 Trends in College Pricing from the College Board.

- Consider going to summer school. By attending summer school at a junior college, students can potentially save hundreds if not thousands off their college expenses. Just make sure to take the description of the course(s) you are considering to your college advisor to make sure they will accept the credits.

Best Web Buys first made a name for itself twelve years ago with the launch of one of the first online price comparison sites- Best Book BuysÒ. Best Book Buys has been helping college students from more than 1500 colleges across the nation find the best prices for their new and used textbooks since 1997. Best Web Buys’ five product specific sites — Best Book Buys, Best Music Buys, Best Video Buys, Best Bike Buys and Best Electronic Buys — compare prices, shipping and availability of more than six million titles and items at hundreds of online stores and thousands of Alibris, eBay, half.com and Amazon marketplace sellers. Steve Loyola, a former Jet Propulsion Laboratory computer scientist, founded the company.