As college students head back to college, many families are struggling with how they are going to meet their college education costs. During a recent session on #CollegeChat on Twitter, Kathy Kristof, (http://twitter.com/kathykristof ) a nationally syndicated personal financial columnist and author of “Investing 101”, shared a number of tips that can help college students shave thousands of dollars off their education expenses.

Check the graduation rate. Before you sign on the dotted line, make sure you know what the school’s graduation rate is recommends Kristoff. “Tuition money is wasted if you don’t graduate and some schools graduate only a few of those who start,” said Kristof. “Private trade schools are notorious for this and they charge as much as prestigious private schools.”

Go to College Navigator, a site operated by the Department of Education, at http://nces.ed.gov/collegenavigator/ and look up graduation rates by school.

Make sure to claim your AP credits. Many students neglect to check to see if their Advanced Placement (AP) classes will transfer. Some colleges set deadlines on how long students have to claim these credits. Remember, the $86 students paid to take an AP test can save you thousands in college tuition. As Sharon McLaughlin (http://twitter.com/shashmc) , founder of McLaughlin Education Consulting, pointed out, “Any course you can be exempt from via AP credit or CLEP will save you the tuition for the course.”

In addition, students who received scores of 3 or higher on at least three AP exams should check with their college to see if they have sophomore standing. If you have sophomore standing and attend a public university you may have saved yourself at least $6,585, the average tuition and fees at a four year public university according to 2008 Trends in College Pricing from the College Board. Students can check out www.collegeboard.com/ap/creditpolicy to see if your AP score may have earned you college credit.

Consider attending Junior College—even for just summer school. “Junior colleges are the best bargain in education,” Kristof explained. “One year at Pasadena City College costs $600 versus $30,000 at a private four year college. In addition, a kid who can’t get into the school he wants straight out of high school can go to a junior college, get a B average and go almost anywhere in two years.”

Grayson Page ( http://twitter.com/g_page ) recommends that students “look at transfer agreements outlined by four year colleges, check the amount charge per credit hour, check College Navigator for completion rates, and register early.”

If enrolled at a four year college, students should consider attending a junior college for summer school. By attending summer school, students can potentially save hundreds if not thousands off their college expenses. Just make sure to take the description of the course(s) you are considering to your college advisor to make sure they will accept the credits.

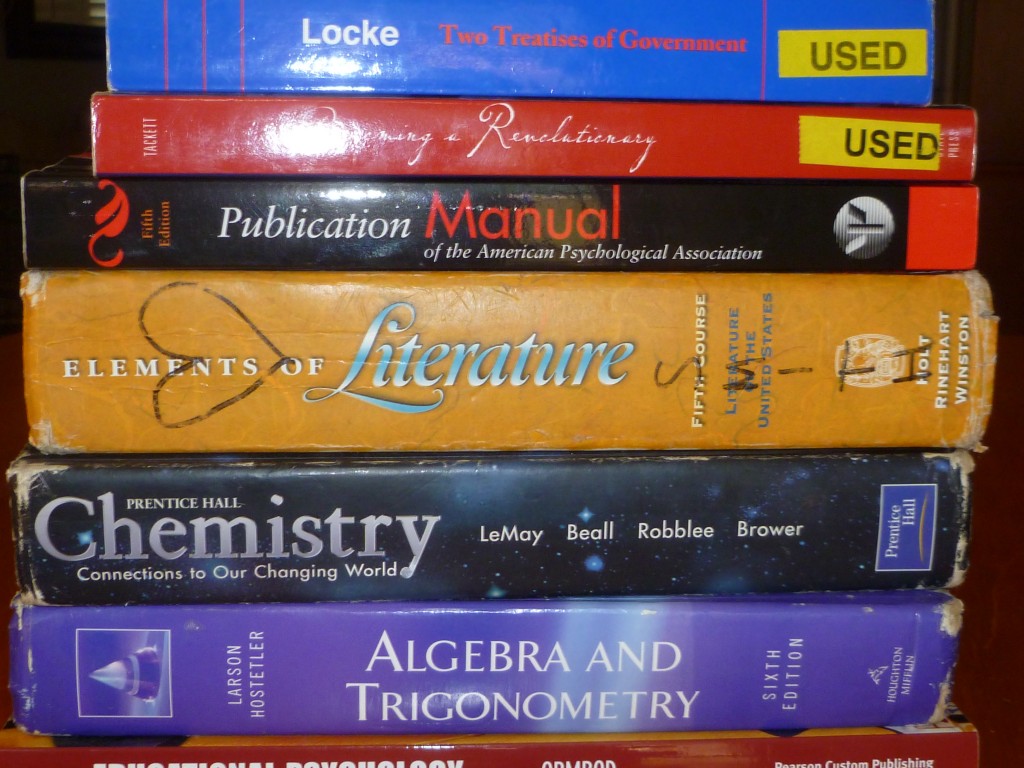

Look for textbooks online. By buying books online, students can potentially save up to 75% of the list price of new textbook, and with textbooks on average approaching $1000 per year for students that can be quite a savings. The best deals are on used textbooks. Comparison shopping sites like http://bigwords.com/ and http://BestBookBuys.com can compare prices at multiple online stores instantly including on the cost of renting textbooks. Kristof also recommends that students look into borrowing their textbooks at the college library or even the local public library as well as swapping books with friends.

Sign up for Skype. By having Skype, students can have an online video chat for free, even internationally, if both people on the “call” are online. Most dorms do not have land lines anymore. If Skype isn’t for you, there are a number of other video chat options. Akil Bello, (http://twitter.com/akilbello) the vice president of Educational Development for Bell Curves, commented that all the “IM programs now have some form of video chat.”

Tauhid Chappell (http://twitter.com/TauhidChappell), a junior at Virginia Tech, also recommends that students get an unlimited text plan for their cell phone service.

Limit Meal Plans. Meal plans can be very expensive and many students won’t use a full meal plan. Suzanne Shaffer (http://twitter.com/SuzanneShaffer) founder of Parents Countdown to College, advised that families “never buy the full meal plan. They won’t use it.”

Kristof recommends that students invest in a fridge for their rooms and stock it with healthy foods. With a fridge, students can forego trips to the cafeteria for some of their meals and get by on a less expensive meal plan. Students may also be able to “work for food” either in the cafeteria or possibly as “hashers” for sororities. Kristof also mentioned that students check out http://groupon.com/ for the best dining deals.

Chandra Robrock ( http://twitter.com/FSUfashiongirl) , a full time college student and part time fashion blogger, suggested that college students sign up for Twitter and look for deals from their favorite eateries. She also recommended that students know what restaurants offer discounts or specials to college students. “The best way to find out about deals is to check their website directly and sometimes there is a coupon you can print out,” said Robrock.

Be careful with borrowing. If you need to take out a loan to pay for college, Kristof recommends that students take out federal loans and only up to the point where the federal loans max out. According to Kristof, “Private loans should be used sparingly if at all. To check them out go to http://www.finaid.org/. Borrowing—particularly private borrowing—should be a last resort.”

However, if you have run out of options and still need to consider a private loan, McLaughlin recommends that undergraduates check with http://www.studentchoice.org/ , a provider of private student lending services to credit unions.

Kathy Kristof is an award winning syndicated financial columnist and author of three books “Investing 101”, “Taming the Tuition Tiger: Getting the Money to Graduate”, and “Kathy Kristof’s Complete Book of Dollar and Sense”. She writes about an array of financial issues, ranging from the impact of legislation to taxes to credit card and financial planning. Nearly 40 million people in more than 50 major newspapers nationwide read her columns, including the Los Angeles Times and the Chicago Tribune. Kristof also writes the “Devil in the Details” column for CBS MoneyWatch. In addition to writing, Kristof is a frequent lecturer at investment conferences and has also appeared on a variety of radio and television news broadcasts.

About #CollegeChat

#CollegeChat is a live bi- monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .