Suzanne Shaffer, founder of Parents Countdown to College Coach, (http://www.parentscountdowntocollegecoach.com/) a web site dedicated to helping parents navigate the college maze by providing the right tools for organization and success, will provide parents and teens with a list of strategies they need to deploy to help ensure success with college admissions on #CollegeChat on Twitter on September 21, 2010 at 6 pm Pacific/ 9 pm Eastern, Theresa Smith, principal of Pathway Communications (http://pathwaypr.com) and moderator of #CollegeChat announced today.

Suzanne Shaffer, founder of Parents Countdown to College Coach, (http://www.parentscountdowntocollegecoach.com/) a web site dedicated to helping parents navigate the college maze by providing the right tools for organization and success, will provide parents and teens with a list of strategies they need to deploy to help ensure success with college admissions on #CollegeChat on Twitter on September 21, 2010 at 6 pm Pacific/ 9 pm Eastern, Theresa Smith, principal of Pathway Communications (http://pathwaypr.com) and moderator of #CollegeChat announced today.

According to Shaffer, author of “Parents Countdown to College Toolkit”, by planning early college bound teens can get a leg up on the college process. During the upcoming live #TwitterChat, Shaffer ( http://twitter.com/SuzanneShaffer) will address and help prioritize high school junior and sophomore’s action items including:

- Tips for how teens can stay organized with college information

- How to ensure teens are taking the right college preparatory classes

- When should students start building a resume and why is it important

- When should students first take the SAT or ACT

- What tests should sophomores take

- How long should students study for test

- Should students take AP courses

- When should students start visiting colleges

- How early should students be looking into scholarships; what resources are available

For over ten years Shaffer has been coaching parents on the college journey and how to find the funds to finance that education. She has counseled parents in admissions, scholarships, financial aid, and the importance of early college preparation. Having been successful in guiding her children and many others to fulfill their dreams of college educations, she is committed to equipping other parents with the right tools necessary for them to become their own “parent coach”. With these tools they will be confident and prepared to guide their college-bound teen in the pursuit of their college dreams. Shaffer is the founder of the highly regarded site Parents Countdown to College Coach.

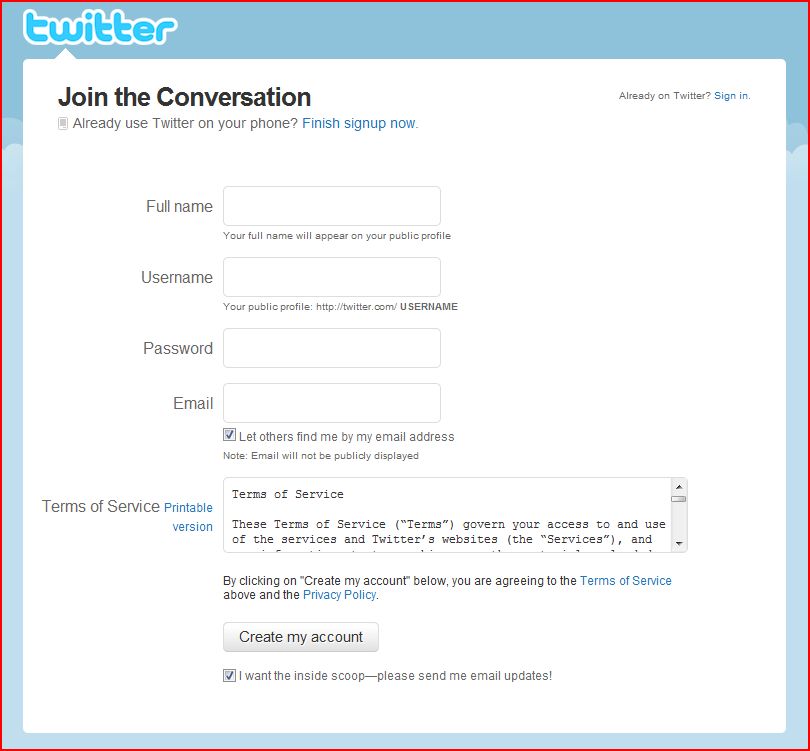

New to Twitter?

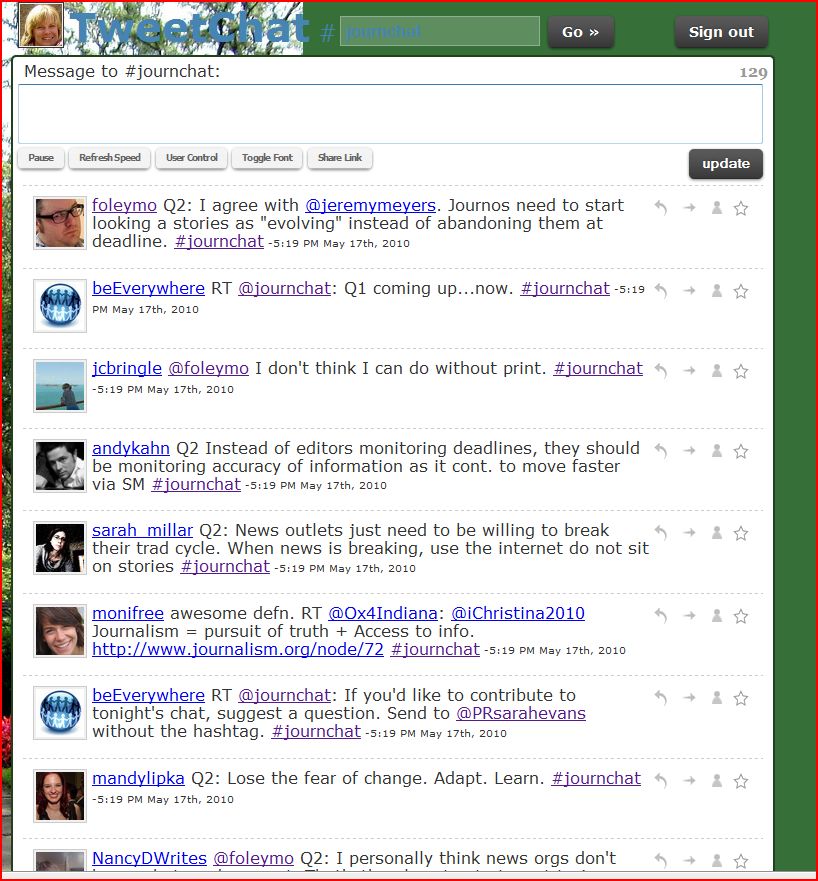

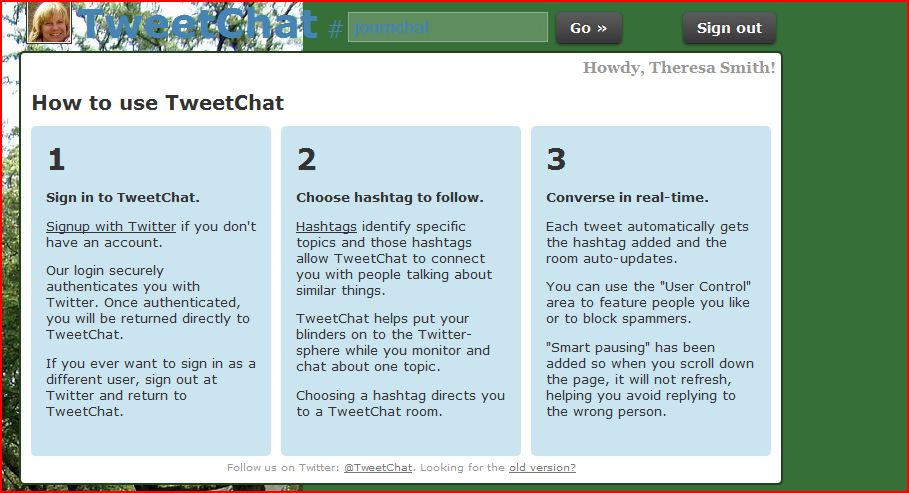

In order to participate in the chat, attendees will need to have a Twitter account. To sign up for a Twitter account, go to http:// twitter.com. The easiest way to follow the chat is to use TweetChat (http://tweetchat.com). Simply log in to TweetChat with your Twitter information (email or username followed by password) and then enter in CollegeChat without the “#” and you will be placed into the chat room with only those participating in #CollegeChat. More detailed information about signing up for Twitter and using TweetChat can be found at http://pathwaypr.com/how-to-participate-in-a-twitter-chat .

About #CollegeChat

#CollegeChat is a live bi-monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .

Los Angeles, CA, May 19, 2010— Bestselling author and higher-education journalist

Los Angeles, CA, May 19, 2010— Bestselling author and higher-education journalist