Kathryn Marion, an award-winning career author and columnist covering the college-to-career transition, will discuss tips for college students and new graduates from her book “Grads: Take Charge of your First Year after College” during the next edition of #CollegeChat on Twitter on June 29, 2010 at 6 pm Pacific/ 9 pm Eastern, Theresa Smith, principal of Pathway Communications and moderator of #CollegeChat announced today.

With college graduates facing a tough job market for the foreseeable future, Kathryn will discuss during the live Twitter #CollegeChat how both college graduates and students can better their chances of landing their first job post graduation. Kathryn will also respond to attendees’ questions during the chat. Kathryn’s tips for college graduates to increase their odds of securing their first job include:

- Fiercely protect your good name and reputation. Clean up your online presence.

- Improve your writing and speaking skills. Start a blog.

- Play the networking game properly. To play properly, build profiles on LinkedIn, Facebook, and Twitter.

- Learn how to manage your time.

- Build a personal board of directors. Create a valuable support group who will help you through all the phases of your job search and career development.

- Remember first jobs don’t dictate your entire career path. Continue to network, to interview people for information, and to job shadow.

Kathryn Marion is the award-winning author of the career and life skills book, “GRADS: TAKE CHARGE of Your First Year After College!”, and a columnist on Examiner.com covering the college-to-career transition and life after college in general. She coaches college students and young professionals on career planning, job search, and life skill concerns, and helps people in all walks and stages of life get published. Kathryn is also the editor of the book series, “The Smartest Thing I ever Did…” The print edition of GRADS: TAKE CHARGE of Your First Year After College! Is available through major online retailers and discounters; the e-book edition is available through www.QwikSmarts.com.

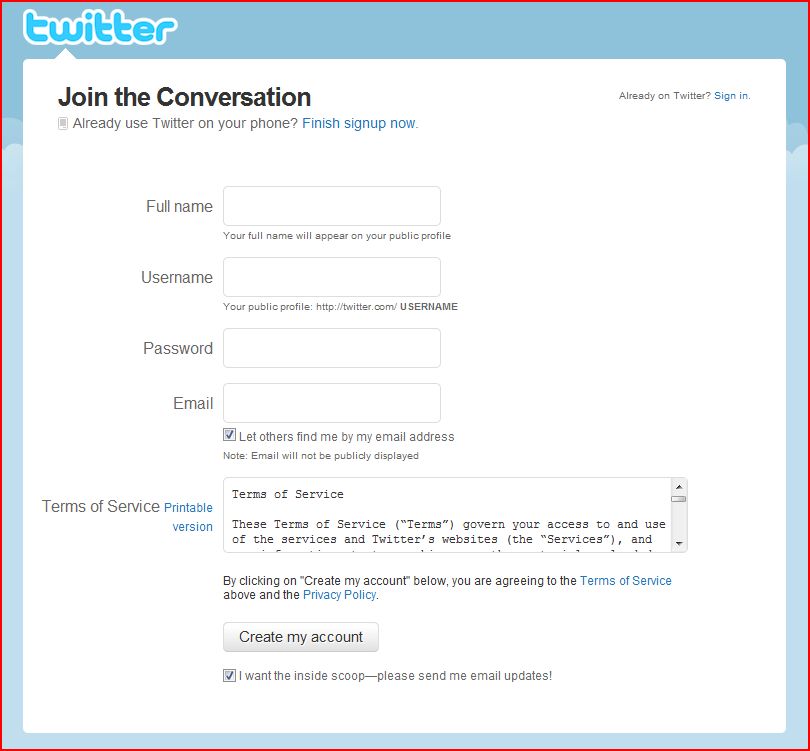

New to Twitter?

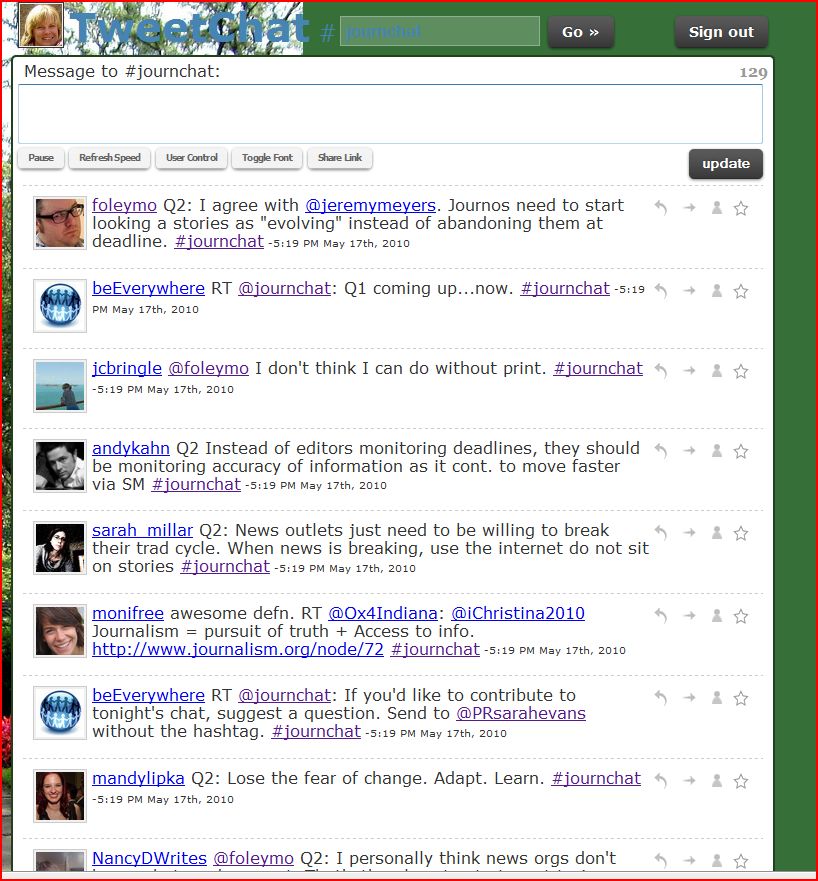

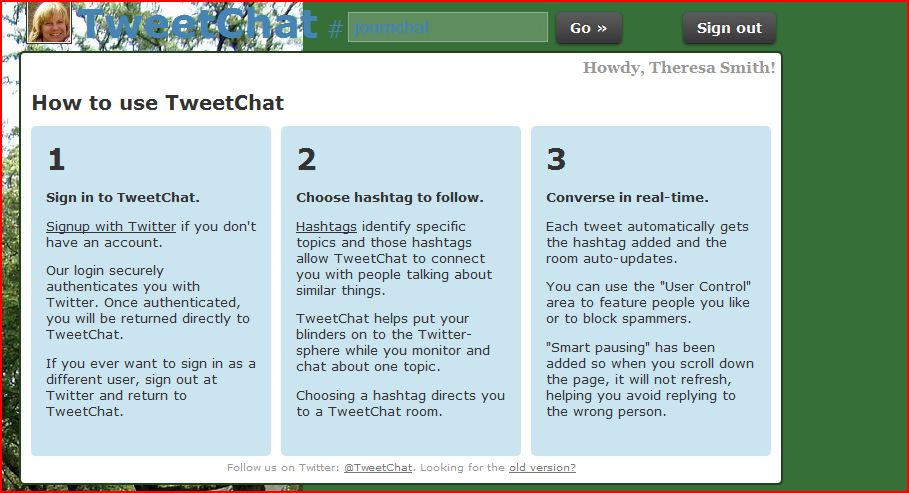

In order to participate in the chat, attendees will need to have a Twitter account. To sign up for a Twitter account, go to http:// twitter.com. The easiest way to follow the chat is to use TweetChat (http://tweetchat.com). Simply log in to TweetChat with your Twitter information (email or username followed by password) and then enter in CollegeChat without the “#” and you will be placed into the chat room with only those participating in #CollegeChat. More detailed information about signing up for Twitter and using TweetChat can be found at http://pathwaypr.com/how-to-participate-in-a-twitter-chat .

#CollegeChat is a live monthly conversation intended for teens, college students, parents, and higher education experts on Twitter. Questions for each #CollegeChat edition can be sent to Theresa Smith, the moderator of #CollegeChat via http://Twitter.com/collegechat , by entering questions online on the CollegeChat Facebook page at http://ht.ly/1XIqV , or by email. CollegeChat can also be found on Twitter at http://Twitter.com/collegechat .

Los Angeles, CA, May 19, 2010— Bestselling author and higher-education journalist

Los Angeles, CA, May 19, 2010— Bestselling author and higher-education journalist